Though the bulls managed to steal the show for the day,the sell-off during the final hour of trade is a sign of concern. The benchmark Sen...

Though the bulls managed to steal the show for the day,the sell-off during the final hour of trade is a sign of concern. The benchmark Sensex and broader Nifty posted

gains of 140 and 42 points respectively. Stocks from midcap and small-cap space also ended the day in the green.On the daily chart, Nifty has formed an inside bar, which

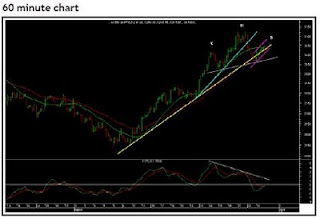

indicates a time of consolidation and the follow up of this inside bar in either direction is a trend-deciding move.On the hourly chart, Nifty is just whipsawing with the bullish trend line and has not yet cleared the hurdle of 20 hourly simple moving average. Also, on the hourly chart,Nifty is forming head-and-shoulders pattern (a bearish reversal pattern), which will get confirmed on the breach of 2962, where its neckline is placed. Further, the right shoulder of the head and shoulders pattern is a bearish flag (a bearish continuation pattern), which will get

confirmed on the breach of the lower boundary of the flag (3000 mark). Bears dominated the market breadth with 827 declines and 365 advances.

The hourly KST is directionless. Our short- and mid-term biases are up for the target of 3150 and 3200 respectively with the short- and mid-term reversal pegged at 2960 and 2738 respectively.

Buying activity was witnessed across sectors with capital goods, realty and healthcare stocks at fore front. However, stocks from energy, fast moving consumer goods and power sectors remained less in favour. From the 30 stocks of Sensex, Jaiprakash Associates (up 7%), Tata Steel (up 5%) and Tata Motors (up 5%) led the pack of gainers. HDFC (down 3%), National Thermal Power Corporation (down 2%)

and ICICI Bank (down 2%) led the pack of losers.

No comments

Post a Comment